There’s no punchline. Sorry.

CBN actually just closed the rDAS/wDAS window via a press release today. But what is rDAS/wDAS anyway?

Retail Dutch Auction System is the method by which CBN sells foreign exchange to those who need it. The rDAS system is the main system the CBN has been using for a while now so perhaps that’s what needs a definition.

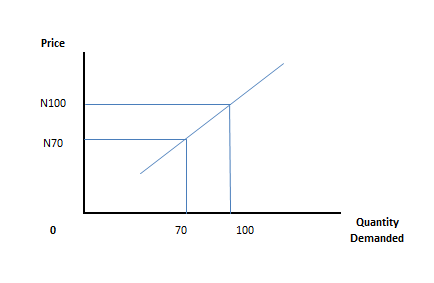

If you need US Dollars as an end-user, you go to your bank and ask for it. You tell the bank what you want to use it for and the bank then takes that request to the CBN asking to buy on your behalf. The bank then collates all the requests from its various clients and takes it to CBN. From the point of view of the CBN, this system allows it know who is demanding for foreign exchange and what they are using it for. In theory, it can then refuse to sell to certain people if it feels their demand is not ‘legitimate’. Of course there is an advantage to buying from the CBN – the rate at which they sell dollars – the official rate – is always much better than what you find on the streets or Bureau de Change.

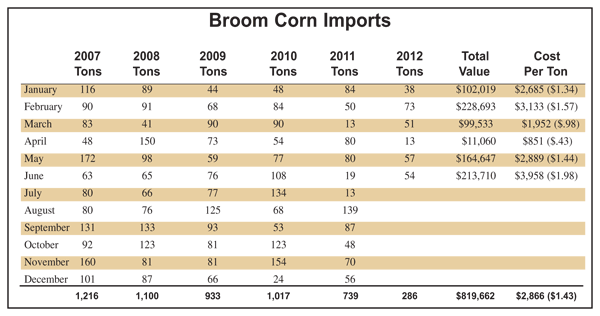

The more requests submitted by banks, the more pressure on the Naira naturally – people will be willing to pay more Naira to get the dollars they want given that the dollar is the scarcer item in that equation. And given that CBN wants to keep the Naira from devaluing, it has to supply more and more dollars to meet requests – It has been supplying over $100m/day in recent times.

So we go to the press release from today.

The managed float exchange rate regime, which the Bank had adopted following the liberalization of the foreign exchange market, has for the most part been successful in ensuring exchange rate stability in line with its mandate.

Think of this as one of those obituary statements in the newspapers where they say ‘it is with a heavy heart that we announce the demise of Chief so and so’. The managed float exchange rate regime that the CBN is talking about is all the ways it has been supplying dollars to the market over the years.

It is saying it has been mostly successful in keeping the Naira successful. But when a statement opens like this, you know something else is coming…

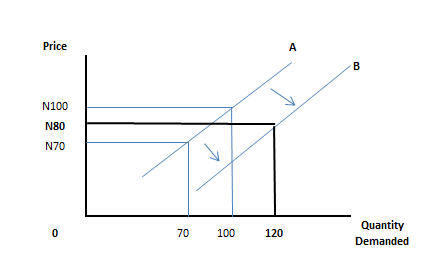

In recent times, however, with the sharp decline in global oil prices and the resultant fall in the country’s foreign exchange earnings, the Bank has observed a widening margin between the rates in the interbank and the rDAS window, thus engendering undesirable practices including round-tripping, speculative demand, rent-seeking, spurious demand, and inefficient use of scarce foreign exchange resources by economic agents. This has continued to put pressure on the nation’s foreign exchange reserves with no visible economic benefits to the productive sector of the economy and the general public.

Ah, here we are. Given all the challenges that the Nigerian economy is going through, the CBN has decided to vote for change.

There is rDAS – which I described above as the rate that CBN sells to the banks, presumably on behalf of its customers. There is Interbank – which is the rate at which the banks sell to themselves. This Interbank rate is of course higher than the rDAS as you can imagine. Why buy from CBN and then sell to another bank at the same rate? even Mother Theresa would not approve of such charity.

CBN is thus saying that the difference between the rDAS and the Interbank (which is closest to what you get from your Mallams) is widening. Given that the CBN is the number one source of dollars in the economy it’s not hard to understand what they are saying – people are buying from CBN and going to sell at Interbank for a profit.

There are two issues here. The first is that CBN is saying some of the requests being submitted on behalf of customers are clearly fake (“spurious demand”). Otherwise why would banks buy from CBN and go and sell to other banks if they were buying strictly for their clients? But you didn’t hear that from my mouth. The second issue here is that dollars are obviously getting scarcer relative to demand. If CBN supplies $100m this week out of say, $150m demanded but then the next week it supplies $120m out of $200m demanded, the dollar is getting scarcer even though CBN has increased the amount it sold (“scarce foreign exchange”).

As the final evidence that this is the work of “economic agents” (a nice name to call people you don’t like), the CBN is saying it cannot see any evidence that the dollars it is selling is being used to import things like agricultural equipment or industrial machines etc (“productive sector of the economy”). In short what is going on is arbitrage by “economic agents” – when you see something available to buy at one price in one location and also see people paying a higher price for it at another location. It will be rude for you to pass up such a profit-making opportunity by connecting price A with demand B. The wider the gap between rDAS and Interbank, the more money people are making obviously. Not nice says CBN.

In view of the foregoing, it has become imperative that appropriate actions be taken to avert the emergence of a multiple exchange rate regime and preserve the country’s foreign exchange reserves. Consequently, we wish to inform all authorized dealers and the general public that, with effect from the date of this press release, the rDAS/wDAS foreign exchange window at the CBN is hereby closed. Henceforth, all demand for foreign exchange should be channeled to the INTERBANK FOREIGN EXCHANGE MARKET.

Is this starting to sound like a coup plotter’s speech or is it just me?

The CBN is now saying it has had enough of your bad behaviour. It no longer wants to be the guy you have put in your friendzone who is funding your other boyfriend…the guy you truly love. You are taking CBN for a fool and it will no longer stand for it.

It has now cancelled the rDAS window. Slammed shut. Banks can no longer come to the CBN every week saying ‘my client asked me to buy $100,000 dollars for them to buy tractors from China for their farm’. CBN is no longer that guy – go and meet the guy you obviously truly love.

Now, if you need dollars, go to the Interbank. Well, as an end-user you really can’t go to Interbank per se. This is simply the market where the bank that has dollars sells to the bank that needs dollars. Because the banks know whats up, it is hard to see how “economic agents” will come and play the same games they have been playing here. We can conclude that the demand at the Interbank will be pretty close to reality.

What does this then mean? Well, we can imagine that even if the bulk of the demand under rDAS was “spurious” as CBN claimed, surely it could not have been all of it? The people who were genuinely demanding dollars through their banks will suffer. They are now as good buying from the black market. If you were going to import machines worth say $10m, the difference you will have to pay now will probably be up to N10/dollar. That’s an extra N100m you have to find.

But the move will strike a blow against speculation – this is like abruptly ending a party and telling everybody to go home.

Most Nigerians have been buying dollars at Interbank rates anyway so on the surface it should not affect them. But it will. Because the Interbank rate is likely to increase given that banks don’t have as much dollars as the CBN has and are likely to sell for as high as they can to each other. This higher rate will probably feed into the economy. But again, the effect might be counteracted by eliminating all those “economic agents” which means demand will not be as high as before, in which case the Naira might not lose value as expected.

We will soon find out either way. If the Naira gains value as a result of this rDAS closure, then we will be able to conclude that the whole thing was to the benefit of “economic agents” in the past and the CBN was right in closing it. If the Naira loses some value against the dollar, then we might also say that genuine people who need dollars are suffering as they have to pay more for what they need.

So what if dollars are so scarce in the market that banks now start selling it for N300/$1 to each other?

For the avoidance of doubt, all authorized dealers and the general public should note that the CBN will continue to intervene in the interbank foreign exchange market to meet genuine/legitimate demands

CBN says calm down. It will still enter into the Interbank market and put dollars up for sale if and when things start to get out of hand i.e. if dollars start to become scarce. If Bank A wants to buy $1m from bank B and bank B says it wants N250/$1, the CBN can get in touch with bank A and offer to sell to it for N225/$1 or something. That will stop bank B from being able to sell for N250 and thus devaluing the Naira further.

What’s the moral of this story? There is none. Let us wait and see.

FF